Ten Ways Customer Experience Can Improve Equitable Access and System Integrity for Unemployment Insurance

This publication shares ten ways states can improve start-to-finish customer experience for unemployment insurance claimants. These approaches can increase overall equitable access and system integrity for UI administration.

Overview

What does the start to finish experience feel like to an unemployment insurance (UI) claimant? This person might be reeling from the emotional and financial shock of losing their job and be thinking about how to manage their bills. On top of that, they may also face a daunting and oftentimes confusing process to apply and certify for UI benefits.

UI modernization is a change management endeavor and requires bold leadership to drive the policy, systems, and culture change required to deliver systems that work for claimants and employers. The ten approaches presented below represent some of the best transformative practices.

Current State of UI Customer Experience

Seven in ten unemployed workers did not apply for UI in 2023 (Bureau of Labor Statistics (BLS). Fifty-five percent of those who did not apply for benefits didn’t believe they were eligible. And ten percent cited barriers to applying or problems with the application process. For eligible workers who belong to groups that historically face disparities accessing government programs—such as low-wage workers, Black and Hispanic/Latinx workers, individuals with disabilities, individuals with limited English proficiency, women, and individuals living in rural areas, individuals with lower digital literacy, limited digital access—it can be even harder. Making the experience in unemployment insurance seamless, accessible, consistent, secure, and efficient can improve equitable access.

Improving customer experience can also improve UI system performance and integrity. The U.S. Department of Labor (USDOL) improper payment rate includes both fraud and non-fraud overpayments. Data from USDOL Benefit Accuracy Management reports and ETA 227 quarterly state-reported data, show that high claimant error rates can lead to millions in UI overpayments. For instance, in Illinois in 2023, 62% of the total $49 million in improper payments were non-fraud, and 57% of that was attributed to claimant error ($29 million). Leading national causes of claimant error are related to confusing terms, and the policy and laws related to them, including but not limited to ‘benefit year ending’, separation issues, work search requirements, and other eligibility issues.

Informing the Future of UI Customer Experience

In June 2024, Digital Benefits Network staff member, Jennifer Phillips, was invited to testify before the U.S. House Ways and Means Subcommittee on Work and Welfare Hearing on Reforming Unemployment Insurance to Support American Workers and Businesses. Specifically, she was asked to testify about ways states are improving equitable access to UI using the American Rescue Plan Act of 2021 (ARPA) UI modernization grants provided by USDOL.

Written Testimony of Jennifer Phillips

Insights and examples from Jennifer Phillips about how state unemployment insurance (UI) agencies are expanding equitable access to unemployment insurance (UI).

Oral Testimony of Jennifer Phillips

Testimony made to the House Ways and Means Subcommittee on Work and Welfare “Unemployment Insurance Reform: Supporting American Workers and Businesses” by Jennifer Phillips.

In July and August of 2024, The Digital Benefits Network hosted a series of webinars, called the Summer of CX. These three webinars expanded on the solutions presented in the testimony and featured best practices from states such as California, Illinois, Michigan, and New Jersey and federal CX leaders from USDOL, the National Institute of Standards and Technology (NIST), and the Office of Management and Budget (OMB).

Summer of CX Webinar Series: Principles to Improve CX

This webinar discusses the White House Executive Order and federal agency guidance for improving customer experience in public benefit programs.

Summer of CX Webinar Series: CX Metrics for Decision Making

This webinar session discusses the importance of using CX metrics to guide agency-level decisions and how to gather, analyze, and apply customer feedback to optimize products and services.

Summer of CX Webinar Series: Improving CX for Benefit Access

This webinar session discusses how to address customer experience challenges presented by digital identity in public benefit programs.

Ten Ways to Improve Customer Experience in UI

What are the barriers to equitable UI access that states are working to address and what solutions show the most promise?

This is not an exhaustive list and there is a growing list of exceptional examples of how states are addressing equitable access in UI.

- Plain language

- Accessibility

- Language Access

- UI Outreach and Lack of Knowledge About Qualifying for UI Benefits

- Website Navigation and How to Apply for Benefits

- Digital User Experience

- Digital Identity Proofing

- Equity Research and Data Analysis

- Human-centered Design and Customer-centric Research

- Staff Training

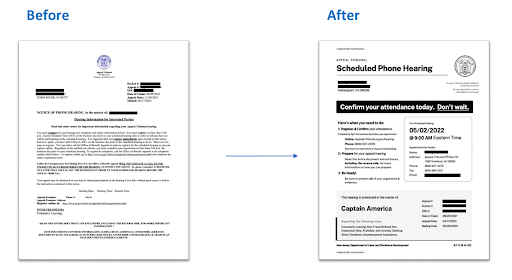

1. Plain Language

Nearly every UI state agency is working to use plain language principles to make the UI experience, from start to finish, easier to understand. Plain language, as defined by plainlanguage.gov, is clear, concise, well-organized, and follows other best practices appropriate to the subject or field and intended audience.

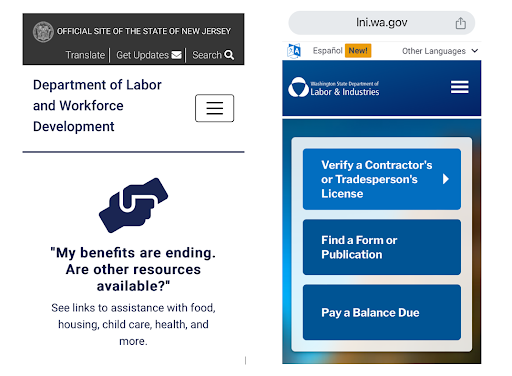

The USDOL created a plain language online repository to provide examples to states. The National Association for State Workforce Agencies (NASWA) has behavioral insights contractors who are working with states such as Nebraska and Nevada on plain language and evaluating and measuring the impact. New Jersey’s overhaul of its UI emails exemplifies the power of making information more accessible and easier to understand.

Source: New Jersey Department of Labor and Workforce Development

Explore Plain Language Resources

The UI Lexicon Project

To better understand the problem and find potential solutions, the U.S. Department of Labor conducted an exploratory UI Lexicon research project.

Unemployment Insurance Email Template Kit v1.0

This kit contains a collection of styles, components, and building blocks to quickly create action-forward emails for Unemployment Insurance programs within the U.S.

Plain Language: Foundations 101 Webcast

This is a video recording of a NASWA Feb 2024 webinar on plain language presented for UI state leaders. Slides are also available.

Accessible Benefits Information: Reducing Administrative Burden and Improving Equitable Access

This guide highlights best practices in benefits access, showcasing how Michigan, New York City, and San José improve accessibility through plain language, multilingual translation, resident co-creation, and technology tools.

plainlanguage.gov

Plainlanguage.gov is the United State’s federal government’s website for improving communication with the public

Plain Language Web Writing Tips

Help your readers complete their tasks with these Plain Language writing tips.

2. Accessibility

State UI agencies are improving accessibility in their websites, call centers, correspondence, handbooks, forms, and more for disabled individuals, as well as building accommodations into processes. Tools built into enterprise software, such as Microsoft Word and Adobe, mean that UI staff can check for document accessibility instantly. In Illinois, there was a backlog of PDF documents attached to the IDES website that were not screen-reader accessible. IDES worked to move PDF content into printable web content as a strategy for making all content accessible and also translated.

Oregon has put their UI claimant handbook on Spotify for blind claimants.

Explore Accessibility Resources

State of Colorado Guide to Accessible Web Services

A toolkit for State of Colorado employees to leverage to ensure all web services are accessible.

M-24-08 Strengthening Digital Accessibility and the Management of Section 508 of the Rehabilitation Act

This memorandum provides guidance to help agencies advance digital accessibility by maintaining an accessible Federal technology environment, promoting accessible digital experiences, and continuing the implementation of accessibility standards.

Best Practices for Accessible Content

Drawing on the Beeck Center’s research on government, nonprofit, academic, and private sector organizations that are working to improve access to safety net benefits, this report highlights best practices for creating accessible benefits content.

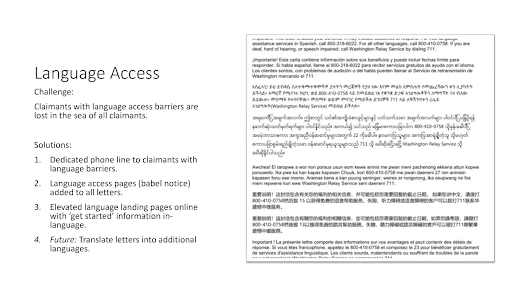

3. Language Access

Most UI state agencies are also hard at work making sure that websites, forms, digital experiences, and correspondence are available in multiple languages. California’s Employment Development Department is using its Equity grant to ensure that its UI application is available in the top eight languages spoken in the state.

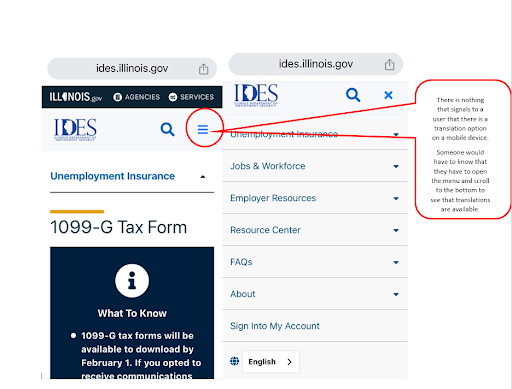

New Jersey and Illinois worked with U.S. Digital Response to implement an English-Spanish UI Glossary.

States like Washington and Illinois, among others, are working to ensure that all UI letters contain Babel notices, which is a short notice in multiple languages that is included in a document and informs the reader they can request language access services to ensure they understand.

States like Pennsylvania, Nebraska, Virginia, among others, have created explainer videos in multiple languages.

Source: Illinois, Washington and New Jersey website mobile views

Source: Washington State Employment Security Department Babel Notice

Explore Language Access Resources

Spanish Translation Guide for Unemployment Insurance

Guidelines and resources to help improve Spanish translations for unemployment insurance (UI) content

AI Translation Assistants for Unemployment Insurance Benefits

Learn how to use generative AI to quickly create unemployment insurance translations that are accurate, easy to understand, and tailored to your state.

SNAP Language Access Study

The study investigates how state agencies administering SNAP comply with Title VI of the Civil Rights Act by providing language access for individuals with limited English proficiency (LEP).

4. UI Outreach and Lack of Knowledge About Qualifying for UI Benefits

USDOL awarded $219.3 million in Equity Grants to 46 states to focus on systematically approaching fairness in processes and eliminating barriers to access. More than a third of the 160 Equity grant projects focus on outreach. Projects incorporated conducting mobile outreach, hiring navigators, working with community organizations, and doing research to better understand how to reach potential claimants and help them to understand the system.

Seven states—Maine, New Mexico, Oklahoma, Oregon, Pennsylvania, Washington, and Wisconsin—received UI Navigator grants to conduct outreach and provide resources to those who have experienced disparate access to UI benefits and services. For unemployed workers whose employers do not share information about unemployment insurance at time of separation, community-based organizations can play a vital role in helping them understand their eligibility and next steps.

Maine’s Peer Workforce Navigator program launched in 2022 and was a partnership between five community-based organizations. Its approach mimicked strategies used by unions in helping unemployed workers applying for UI. A Century Foundation case study found that: “the combination of rapid response efforts, job fairs, and walk-in clinics at both the Career Center and Peer Workforce Navigator partners all informed claimants of their rights in an effective way and provided support to a community that needed the intervention.”

Alabama has an ombudsperson program and Connecticut has an unemployed worker advocate program, which both function like state-run versions of legal aid and are designed to reduce barriers to receiving benefits and help unemployed workers navigate the appeals process.

Even if you know about UI, it can be confusing to know whether to apply. Several states— California, New York and Oregon—have online estimation calculators to help applicants better understand their eligibility and an estimated benefit amount.

Explore Outreach Resources

NJDOL Benefits Eligibility Tool

A beta version of a screening tool that lists benefits programs that New Jersey residents can use to determine what benefits they are eligible for.

Community Navigators Can Increase Access to Unemployment Benefits and New Jobs While Building Worker Power

Evidence from the Maine Peer Workforce Navigator program shows that workers and government can benefit from well-designed community partnerships.

SNAP Language Access Study

The study investigates how state agencies administering SNAP comply with Title VI of the Civil Rights Act by providing language access for individuals with limited English proficiency (LEP).

5. Website Navigation and How to Apply for Benefits

Michigan Unemployment Insurance Agency procured the services of Civilla, a human-centered design nonprofit, to create a claimant UI roadmap with step-by-step instructions and holds claimant online help sessions multiple times a week. Michigan also has 10 regional community liaisons ready to assist unemployed workers. Illinois recently revised its website to include 10 Things You Should Know and Information Needed to File Online.

Investing in UI website navigation also has the potential to improve overall UI system performance. In Illinois, we knew that the call center volume ballooned annually in January through April with requests for 1099-G tax forms. Over the past two tax seasons, IDES worked to clarify the process to claimants on its website and through an email campaign to encourage self-service online. These simple customer experience-friendly steps resulted in a dramatic decrease in call volume.

6. Digital User Experience

The majority of UI claimants are applying, certifying, and interacting with state UI agencies in a digital environment. Prior to the pandemic, states were not conducting usability testing, but since ARPA, states have not just been conducting user acceptance testing (UAT)—which is the bare minimum to see if the system performs as expected—but actually conducting iterative user experience testing to gain insights for accessibility and incorporate user feedback.

States are modernizing applications, working to simplify questions, code in more languages, and ensure mobile-friendliness. States are also working to modernize online portals, where claimants can check the status of their claim, see benefit amounts, certify for benefits, see correspondence and key documents such as 1009G tax forms, and set up direct deposit.

States like South Carolina and Georgia have new portals, updating technology built decades ago. At the end of May, New Jersey announced that its simplified application is fully phased-in, allowing applicants to save progress and come back later and making things easier on the back end by ensuring that applicants fill out the forms correctly. As a result, there’s been a 14-percent reduction in applications requiring manual review. New Jersey’s successful modernization project will continue to serve as a model for states across the country as they continue to deploy ARPA funds and work with USDOL to upgrade their systems and processes.

Illinois is planning to use a portion of its Equity grant and new IT Modernization grant to update its online UI application and claimant portal. The current application can be completed on a tablet or mobile device, but it is not easy for claimants and the design is prone to mistakes with dropdown menus that are hard to navigate.

Explore Digital Experience Resources

Digital Services Playbook

The playbook outlines 13 essential principles for effective digital projects drawn from successful practices from the private and public sectors.

A Playbook for Improving Unemployment Insurance Delivery

This playbook offers a comprehensive guide to enhancing unemployment benefits systems, focusing on claimant-centric approaches, equitable access, and actionable steps for state agencies.

Improving State Unemployment Insurance Technology: A Guide for Advocates

This guide is intended to provide everything else, with a focus on the basics of UI technology projects, guidance on standards for equitable uses of technology, and strategies for how to have a positive impact on these projects.

7. Digital Identity Proofing

State agencies must balance equitable access with system integrity and fraud prevention. States can use a risk assessment approach to help make decisions about whether and how to include authentication and identity proofing.

In December 2024, the Digital Benefits Network released updated data on authentication and identity proofing in online applications for unemployment insurance and other benefit programs. Key findings in the 2024 dataset included that 49 of 53 state and territorial workforce agencies require claimants to create an account before they can file an unemployment claim. Identity proofing requirements or prompts remain most common in unemployment insurance applications: 31 state workforce agencies require identity proofing or verification processes at some point before, during, or after the initial filing process. A number of states, such as Arkansas and New Jersey, allow claimants to initiate a claim before completing identity proofing and thus starting the application process sooner, followed by a later full proofing step before payment. When identity proofing is placed in front of an application or submission process, an eligible individual’s ability to file a claim in a timely manner could be delayed if they encounter technical issues, lack needed documentation, or otherwise choose to abandon the application process.

Many state systems previously relied on knowledge-based verification (KBV) questions that present users with a series of questions about their private information—including information from their credit history. KBV is not considered a secure approach to proofing identities according to the National Institute of Standards and Technology (NIST) and U.S. Government and Accountability Office (GAO), and also creates obstacles for people with limited credit history. During the pandemic, many states pivoted to prompting users to upload identity documentation and selfies to be verified using facial recognition technologies. The use of biometric comparison can also present accessibility and equity issues for those unable to complete those processes.

The DBN’s research in 2024 also found more state unemployment insurance agencies were providing different pathways for identity proofing (e.g., adding options for in-person identity verification at a kiosk). In some states, this includes a partnership USDOL developed with the US Postal Service and the General Services Administration for a non-digital pathway for people to prove their identity. An earlier ARPA claimant experience grant to Arkansas piloted this approach and now it is operational in over 16 states, including Colorado, Hawaii, Kansas, Massachusetts, Maine, New Hampshire, New Jersey, North Carolina, Ohio, Oklahoma, Oregon, Texas, Utah, West Virginia, and Wisconsin.

Having high confidence that someone is who they say they are can help improve access to services and system integrity. Agencies can help claimants by providing clear, step-by-step information, including what documents they need to have ready to create accounts, how to complete multi-factor authentication, and verify their identity. Illinois recently revised its website to help provide the right information to create an account and reset a password.

Explore Digital Identity Resources

2024 Edition: Account Creation and Identity Proofing in Online Public Benefits Applications

In December 2024, the Digital Benefits Network released an updated open dataset on authentication and identity proofing requirements across various public benefits applications to highlight best practices and areas for improvement in identity management.

What is Digital Identity?

In this updated primer, the DBN introduces the concept of digital identity, and provides brief snapshots of digital identity-related developments internationally and in the U.S.

Promising Practices for Digital Identity in Public Benefits

This piece highlights promising design patterns for account creation and identity proofing in public benefits applications. The publication also identifies areas where additional evidence, resources, and coordinated federal guidance may help support equitable implementations of authentication and identity proofing, enabling agencies to balance access and security.

Digital Authentication and Identity Proofing in Unemployment Insurance (UI) Applications

On May 19, 2023, the Digital Benefits Network published a new, open dataset documenting authentication and identity proofing requirements across online SNAP, WIC, TANF, Medicaid, child care (CCAP)applications, and unemployment insurance applications. This page includes data and observations about authentication and identity proofing steps specifically for online unemployment insurance applications.

Digital Identity Risk Assessment Playbook

This playbook is a method to apply the National Institute of Standards and Technology (NIST) Special Publication 800-63-3 Digital Identity Guidelines.

A large-scale study of performance and equity of commercial remote identity verification technologies across demographics

This study assesses five commercial RIdV solutions for equity across demographic groups and finds that two are equitable, while two have inequitable performance for certain demographics.

8. Equity Research and Data Analysis

Several states are analyzing large data administrative sets to understand and identify equity disparities. States like Michigan and Pennsylvania have public data dashboards. Illinois is using a portion of its Equity grant to examine equitable access differences in an unemployed worker’s likelihood to file, timeliness of first payment, and exhaustion of benefits.

Explore Equity Resources

A large-scale study of performance and equity of commercial remote identity verification technologies across demographics

This study assesses five commercial RIdV solutions for equity across demographic groups and finds that two are equitable, while two have inequitable performance for certain demographics.

Administrative Burdens and Economic Insecurity Among Black, Latino, and White Families

This study investigates how administrative burdens influence differential receipt of income transfers after a family member loses a job, looking at Unemployment Insurance, Temporary Assistance for Needy Families, and the Supplemental Nutrition Assistance Program.

How to Improve Unemployment Insurance for People with Disabilities

The report beings by briefly describing the challenge that disabled workers face in accessing UI and the benefits of reforming the system to better serve these workers. The report then presents a list of considerations for UI reform in the areas of administrative process and technology improvements as well as considerations for policy change.

9. Human-centered Design and Claimant-centric Research

Bolstered by the White House executive order on customer experience, USDOL has encouraged states—especially in the Tiger Team consultations and in UIPL 01-2— to use human-centered design and customer experience strategies to pinpoint pain points and develop solutions. States are analyzing data points from claimant journeys.

Illinois plans to update its UI claim application and online claimant portal. Before changing the technology, Illinois needed to know what pain points users experienced.

- Asking claimants about their experience

- Illinois attached a customer satisfaction survey at the end of its online UI application in April 2020. With USDOL help, Illinois improved the survey and began analyzing the data on a weekly basis to pinpoint claimant pain points. This process was shared on the USDOL Blog: Evaluating customer experience with survey design.

- Observational Research

- Illinois also engaged in live claim filing observational research in September 2023 to better understand where claimants were getting stuck in the application and where they needed staff assistance. This research was also shared on the USDOL Blog: Improving UI benefits delivery through direct observation of UI claimants.

- Friction or Funnel Analysis

- Illinois pulled analytic data from its benefit system to look for the places where claimants abandoned either the online application or the weekly certification process. This was an attempt to find specific places in either process that were confusing to claimants and/or where errors were occurring. This was essential to do before updating the technology for an old application.

- User-testing

- New Jersey has openly shared all of its user-testing on communications to claimants, including how the research was conducted.

Explore HCD Resources

Human-Centered Design Guide Series

A series of guides from Digital.gov to help you understand and practice human-centered design

Executive Order on Transforming Federal Customer Experience and Service Delivery to Rebuild Trust in Government

Executive Order 14058, issued by President Joe Biden on December 13, 2021, aims to enhance the federal customer experience and service delivery to rebuild trust in government.

Unemployment insurance modernization: Examples from states and territories in their unemployment insurance modernization journeys

The U.S. Department of Labor is working with states, territories, and the public to develop strategies to continuously improve the nation’s unemployment insurance (UI) systems.

Benefits Playbook for Designing Human-Centered Applications

By implementing these best practices, states can improve the experience of accessing essential public benefits programs.

Starting Small with Human-Centered Redesign: Approachable Ideas for State and Local Public Benefits Agencies to Improve Applications, Renewals, and Correspondence

This guide highlights approachable ideas for state and local public benefits agencies to improve applications, renewals, and correspondence. As outlined in this resource, even small improvements can be transformative for residents and caseworkers alike.

Going Big with Human-Centered Redesign

This guide provides practical insights for benefits administrators on redesigning benefits systems using human-centered design to ensure all eligible residents can access crucial social safety net resources.

10. Training for State Staff

USDOL created a UI equitable access toolkit and, in partnership with the National Association of State Workforce Agencies (NASWA), a UI equity training for state employees. Implementing equitable access and customer-centric initiatives at all levels requires scores of state employees to shift mindsets and learn new ways of working. In Illinois, as part of the Equity grant, more than 33 staff from six divisions were trained in plain language. To further grow the bench of staff who understand the importance of the claimant experience, IDES developed an intranet training site for staff called Plain Language, Accessibility, and Translation for Equity (PLATE). This site contains on-demand plain language training, how-to examples for thinking about PLATE in daily workflows, and links for other resources.

Does your state need support with any of the plays?

The Digital Benefits Network is here to help! We can support you in navigating ideas, resources, and organizations to improve claimant experience.

US Department of Labor Resources

USDOL issued policy guidance to states in November 2023 with UIPL 01-24, with specific explanations about what efforts to increase equity should accomplish and defining and equitable access as being able to use the system without facing undue burdens or barriers.

USDOL also established a website for the Office of UI Modernization that supports states in their modernization efforts. This site is an essential repository for states to access best-in-class information on customer experience, new technology and automation, plain language, sample code for a modernized UI application, claim status examples, and more.

In addition, USDOL has published several ARPA UI Modernization reports that illustrate the range of projects states are working on to improve equitable access.

- Promoting Equitable Access to Unemployment Compensation Programs

- In May 2023, AIR completed an overview of state equity grant strategies for USDOL. $219.3 million in Equity Grants were awarded to 46 states to focus on systematically approaching fairness in processes and eliminating barriers to access. States are implementing more than 160 projects addressing technology improvements and claimant communication linked to underlying equity barriers for specific populations and AIR identified seven primary equitable access topics.

- Tiger Team Cohort Trends and Updates

- Multiple Tiger Team states were working on equitable access recommendations centered on simplified communication/plain language, translation, online and offline accessibility, claim status updates, website content navigation and accessibility, equity and accessibility data and metrics, community engagement, and continuous improvement feedback loops.

- Insights and Successes: American Rescue Plan Act Investments in Unemployment Insurance Modernization

- This report shares core equitable access issues and plentiful state examples including: plain language, accessibility, translation (highlighting Montana’s work to make letters easier to understand), staff-led assistance and outreach (highlighting Alabama’s UI ombudsperson approach), and enhanced data reporting and analysis to understand disparities.

- Building Resilience: A Plan for Transforming Unemployment Insurance

- This April 2024 transformation plan responds to the GAO report that put the UI system on its High Risk list, referenced in the introduction. It details the activities and strategies completed and those underway and being pursued by USDOL. It also contains recommendations that directly address the critical challenges identified by GAO. The plan outlines seven key action areas that, in combination, will build a resilient UI system capable of responding effectively to future economic challenges. Several of the action areas relate to improved access and experience in UI. The second action area (delivering high-quality customer service) and fifth action area (ensuring equitable access to robust benefits and services) reinforce previously highlighted challenges and solutions.

Explore USDOL Resources

Modernizing Unemployment Insurance: Lessons From The Tiger Teams

This report presents findings from a review by the Bipartisan Policy Center of DOL’s Tiger Teams initiative.

Building Resilience: A Plan for Transforming Unemployment Insurance

The GAO placed the UI system on its High Risk List in June 2022, leading the DOL to develop a transformation plan detailing activities and strategies for building a resilient UI system capable of responding effectively to future economic challenges.

Improving Unemployment Insurance Applications with CX Principles

This resource contains principles and examples of high-impact improvements to consider making in different parts of the online application.

Improving mobile usability for claimants

This webpage from the U.S. Department of Labor (DOL) provides guidance on improving mobile usability for Unemployment Insurance (UI) systems to enhance customer experience and accessibility.

Customer Experience Principles for Unemployment Insurance

The blog post sets up a foundational perspective on CX principles for the state UI agencies.

Unemployment insurance modernization: Examples from states and territories in their unemployment insurance modernization journeys

The U.S. Department of Labor is working with states, territories, and the public to develop strategies to continuously improve the nation’s unemployment insurance (UI) systems.

New CX Guidance to State UI Agencies

On December 31, 2024, USDOL released a new Training and Employment Notice, TEN 18-24, entitled Customer Experience Checklist and Resources for Unemployment Insurance Programs. This TEN provides state UI agencies a customer experience checklist as a way to help them develop a baseline of practices to identify areas that need improvement.

“Facilitating effective CX can reduce potential barriers that impact individuals’ ability to complete required tasks that are associated with UI processes, such as submitting an initial claim, engaging in fact-finding for adjudication, requesting and participating in appeals, completing weekly certifications, and improper payment reduction and overpayment recovery activities. If CX considerations and improvements are interwoven with a SWA’s existing processes, then individuals are more likely to complete tasks accurately, timely, and more independently (i.e., requiring fewer SWA staff interactions). Information about CX is most effective when utilized as a tool for continuous improvement, with states tracking CX metrics at regular intervals, making changes that can address pain points, and measuring CX again to see if it has improved.”

By embracing a customer-centric approach, SWAs can achieve:

- Increased level of trust and satisfaction: Building confidence and trust by making the UI process easier for claimants, employers, and agency staff.

- Reduced administrative burden: Streamlining processes and improved self-service options that lead to greater operational efficiency.

- Strengthened public perception: Positive UI experiences contributing to a stronger image of state agencies and the UI system as a whole.”

Beeck Center Resources on UI

In December 2023, the Beeck Center published “Promising Practices in State Unemployment Insurance Digital Service Delivery,” and cited examples in Oregon on language access; New Jersey on their plain language, mobile-friendly application as well as language access; Michigan on its new claimant roadmap and first-time filer coaching sessions; and Illinois on its equity-focused research.

In May 2024, the Beeck Center published “Promising Practices to Increase Equitable Access in Unemployment Insurance,” and cited examples from Missouri on language access; Nebraska on claimant communications; Nevada on user testing for claimant communications; and Maine on outreach to claimants and partnerships with community-based organizations.

In June 2024, the Beeck Center published “Unemployment Insurance Technology Pain Points Across Three States,” which interviewed advocates from Massachusetts, Michigan and Washington about common UI pain points.The Beeck Center was contracted by NASWA, in partnership with the U.S. Department of Labor, to research and publish two reports on the Open UI Initiative. OUII is working to strengthen the unemployment insurance (UI) system with a focus on how modern technology and digital practices can make state systems more accessible, resilient and secure. The Open UI Initiative aims to change how states create and purchase technology.

Unemployment Insurance IT Modernization Grant Projects: Phase 1 Summary Report

This report summarizes our findings and observations including effective strategies in state UI system modernizations, challenges reported by state UI program teams, areas of opportunity for helping states meet UI modernization goals, and recommendations for supporting states’ UI modernization efforts.

Unemployment Insurance IT Modernization Grant Projects: Insights Report

This report outlines the evolving experiences and key insights from nine of the 19 states implementing projects supported by $204 million from the U.S. Department of Labor’s (USDOL) Unemployment Insurance (UI) Information Technology (IT) Modernization Grants.