Project Snapshot: The “Income Passport”: Income Verification for Gig Workers in Louisiana and Alabama

In response to COVID-19, the Workers Lab and Steady developed the “Income Passport” to streamline gig workers’ unemployment benefit applications by pulling income data directly from gig platforms and financial accounts. This tool reduced manual verification time, helped prevent fraud, and improved workers’ access to full benefits, with successful tests in Alabama and Louisiana demonstrating significant time savings and improved service delivery.

Problem Statement

In response to the COVID-19 pandemic, the federal government made gig workers countrywide eligible for unemployment benefits for the first time through the Pandemic Unemployment Assistance (PUA) and Mixed Earners Unemployment Compensation (MEUC) programs. These benefits helped expand the social safety net during a time of crisis, but states were not equipped to quickly process the volume of applications they received. Overall, this strained state capacity and, especially early in the pandemic, increased avenues for fraud. Many eligible gig workers also struggled to provide the necessary income information, and income verification issues resulted in delayed or denied benefits for gig workers. State workforce agencies needed to find ways to efficiently make sense of and verify income from gig work, which can be generated from multiple sources at multiple times, sometimes even within the same day.

Project Description

The Workers Lab, a nonprofit dedicated to supporting the safety, health, and economic prosperity of all workers through research and advocacy, partnered with Steady, a mission-driven consumer technology company, and two states, Alabama and Louisiana, to develop and test a technology solution to fix the difficult manual process of verifying gig income in unemployment benefits applications. Their solution, an “Income Passport,” pulls income data directly from the gig platforms workers use (e.g., Uber or Instacart) and a worker’s financial accounts, including banks, credit unions, payroll and prepaid debit cards, and digital wallets (like PayPal). This income data is summarized in a report of income information that can be read by both machines and humans. This approach allows applicants and state staff to avoid manually gathering and interpreting the often complex array of paper and digital documents needed to document income generated from gig work.

Workers Lab and Steady conducted design sprints and testing stages with the Louisiana Workforce Commission (LWC) and the Alabama Department of Labor (ADOL). The LWC sprint focused on the backlog of PUA claims, and eventually disaster unemployment assistance in the wake of Hurricane Ida. The ADOL sprint worked through the agency’s backlog of pandemic unemployment benefit claims. Following testing of the Income Passport with both applicants and state staff in the benefits application process, feedback was collected from both stakeholder groups.

Project Outcomes and Impact

Feedback on the test cases came from in-depth interviews with ADOL staff and high-level data summaries from both ADOL and LWC. The Workers Lab conducted phone interviews with workers who submitted an income report using the Income Passport and those who didn’t use the Passport to hear about their experiences applying for pandemic unemployment benefits.

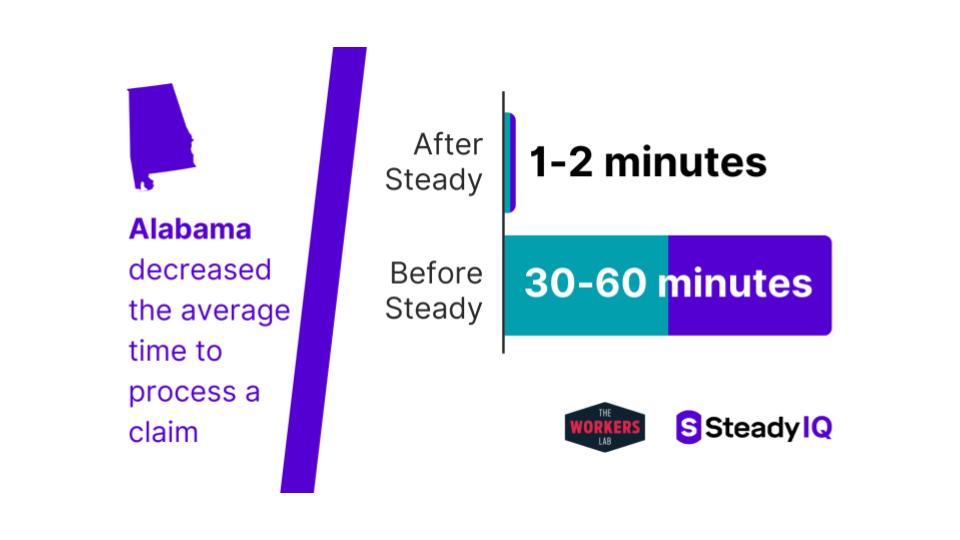

Overall, the Income Passport helped enable automation for the first time for unemployment assistance applications in Alabama, automatically processing 35% of the claims as eligible and cutting down the time needed for additional review to less than 5 minutes. Previously, claim processing could last anywhere from 15-60 minutes because income documentation could come from multiple sources in multiple formats that required manual verification and cross-checking from staff. By pulling income verification directly from workers’ relevant accounts, the Passport helped clear issues in applications before they required manual review. The process also helped prevent fraud, potentially because fraudulent applicants were less likely to use the “Income Passport” tool, or because the approach created fewer false positives.

In Louisiana, the passport reduced LWC staff workload and helped the state close out its pandemic unemployment benefits program while distributing benefits more effectively. Once they received an income report, LWC could approve claims and release payment to workers in under 24 hours. The original manual approach took approximately three weeks.

Additionally, the Income Passport tool helped improve workers’ outcomes in the unemployment process. Completing the income verification process allowed workers to be eligible to receive benefits if they had not yet been approved, or to receive benefits higher than the minimum amount. By enabling workers to more easily report their complete earnings, the Passport made it more likely that workers could access the full amount of benefits for which they are eligible. In Alabama, for example, ADOL provided minimum benefits of $114 per week to eligible workers; by verifying their income, workers could become eligible for up to $275 per week.

Replicable Takeaways

Through the design sprint, both workers and state administrators were consulted and involved in the design of the Income Passport. This project shows how technical solutions and collaboration can improve outcomes for states and workers. The Income Passport approach can also be used and scaled to help states conduct income verification for other benefit applications by improving income verification from gig work, such as SNAP and Medicaid. Steady is currently working with additional states to deploy the Income Passport in more parts of the unemployment and safety net system. This type of user-friendly and burden-reducing technology has multiple potential applications, and the sprint process presents opportunities to transform service delivery for crucial programs, think thoroughly about ways to design state support, and engage the individuals that policies are meant to serve.